With the fixed rate cliff looming as around half of all fixed-rate loans are due to expire this year.

Many borrowers will potentially see their repayments rise by 63%, it’s no surprise that many will be looking around for the best deal.

If your fixed rate is due to expire, it’s a good idea to get an understanding of how much it actually costs to switch lender. Below is a guide on the typical costs to be expected.

Refinance costs to consider

1. Application fees

If you’re switching lenders, it’s not unusual to pay a mortgage application or establishment fee. This covers the cost to your new lender of processing your application.

Lender charges can vary with some not charging a fee at all and others charging for the following:

- Application or establishment fees between $100 and $1,000

- Annual package fees – these vary depending on the type of loan and can range between $300 and $400 per year

- Monthly fees – some lenders will charge around $8 to $10 per month for offset accounts

2. Discharge fee

Lenders saying goodbye to you can also incur a cost, typically around $300 to $400 this fee is for processing your discharge. There will also be a discharge fee paid to the land registry (WA Landgate fee is currently $203).

3. Valuation fee

Many lenders no longer charge a separate valuation fee and with some it is covered by the application or establishment fee, but there are still a few lenders that will pass on the fee from the valuer. These can range between $100 and $400. If you are switching multiple properties then it’s more common to be charged additional valuation fees.

4. Break fee

If your loan is fixed and you are switching prior to to the expiry date, you will likely be charged a break fee. Lenders usually charge a fee of around $300 to process, but there may be additional charges depending on your fixed rate and the current variable rate.

5. Settlement fee

When your loan switches over and the mortgages are registered, they are usually processed by a conveyancer or the banks solicitors. Again, some lenders will absorb these costs, but others will pass on these charges.

6. Mortgage registration fee

The land registry will also charge a fee to register the new mortgage (WA Landgate fee is currently $203).

7. Mortgage broker fee

At Fox Mortgages we do not charge you a fee for our service, some brokerages may charge a fee which should be disclosed up front in a credit quote.

So can you really save by switching?

After the exhausting list of what it could cost you to switch it could appear that it’s not worth it at all? Whilst there appears to be a lot of cost if these are recouped within a reasonable period of time and the mid to long-term benefit produces savings then it’s worth considering.

Refinancing example:

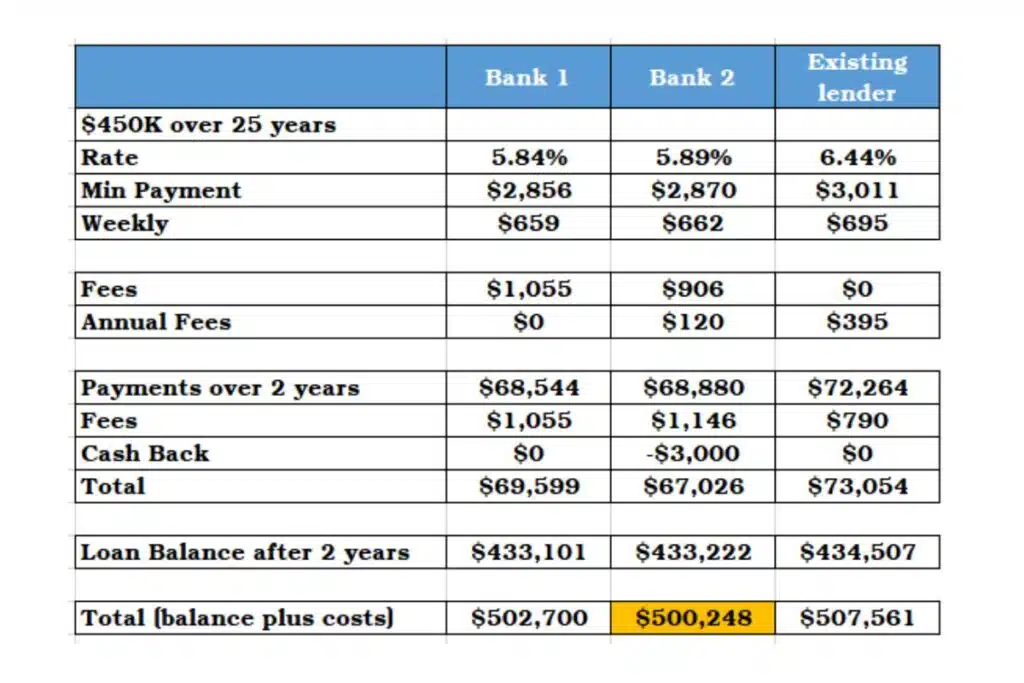

You’re an owner-occupier with $450,000 owing on your current loan. Your interest rate is 6.44% p.a. and you have 25 years left of your term.

If you switch to a loan with an interest rate of 5.89%, you could save up to $59,400 over the course of your loan. Of course that’s subject to rates never changing and paying the minimum payment.

Realistically you need to weigh it up over the short term too and see if paying around $1,000 in fees is worth it. The refinancing example above shows a comparison between 2 potential lenders and the existing home loan. This is for illustration purposes only as there are a few other factors that could impact the lender offer (credit worthiness, loan to value ratio etc.).

If you look at all the costs associated over a 2 year period it would like this:

Assumptions:

Fees:

- $350 discharge

- $406 Landgate registration and discharge fee

- Lender 1 set up $299

- Lender 2 set up $150

- Lender 2 $10 monthly fee

- Lender 2 $3,000 cash back

When making the decision if you looked at the 25 year term remining the best option is Bank 1 as you would save $59,400 over the 25 years compared to a saving of $55,448 with Bank 2. Those figures change over a 2 year period, Bank 2 is the cheapest due to cash back, saving $7,313 compared to a saving of $4,861 with Bank 1.

Want to look at your options?

As accredited finance brokers, we can help you decide whether refinancing is the right move for you in the current economic climate. We can help you weigh up the costs versus the benefits of refinancing and explain whether a different loan could better suit your financial situation and goals. Get in touch today.