“Pay your mortgage weekly instead of monthly and you will knock years off it and save thousands of dollars!”

There’s been a myth for a long time that if you pay your mortgage weekly instead of monthly you can save huge amounts of money and significantly reduce your loan term.

Let’s explain how we think the myth came about and the reality of paying weekly.

There is a slight interest saving by switching to weekly as interest is usually calculated daily on the principal amount outstanding, therefore if you pay weekly instead of monthly you have paid in advance.

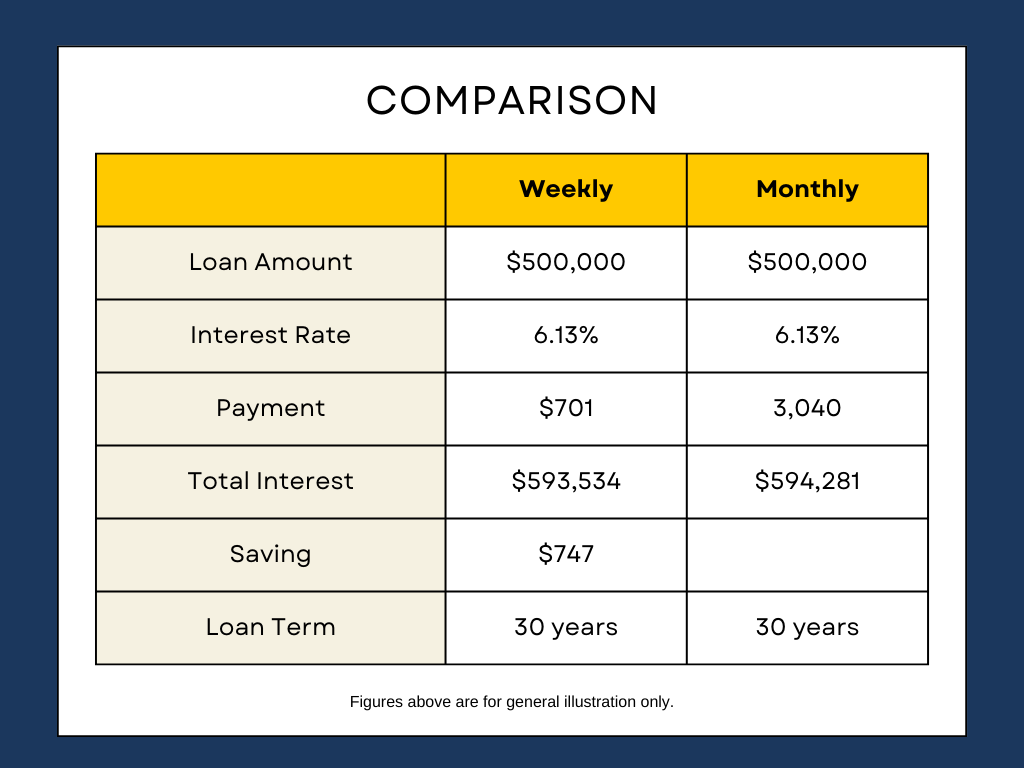

This example shows the impact that paying weekly does to your loan.

The loan is based on a 30-year loan at a variable interest rate of 6.13%. The total interest saved over 30 years equates to almost a week’s payment.

The myth appears to have come about from the way weekly payments are calculated.

In the above example, the weekly payment can be calculated by dividing the total annual payments by 52. $3,040 x 12 months is $36,480. This divided by 52 is $701.

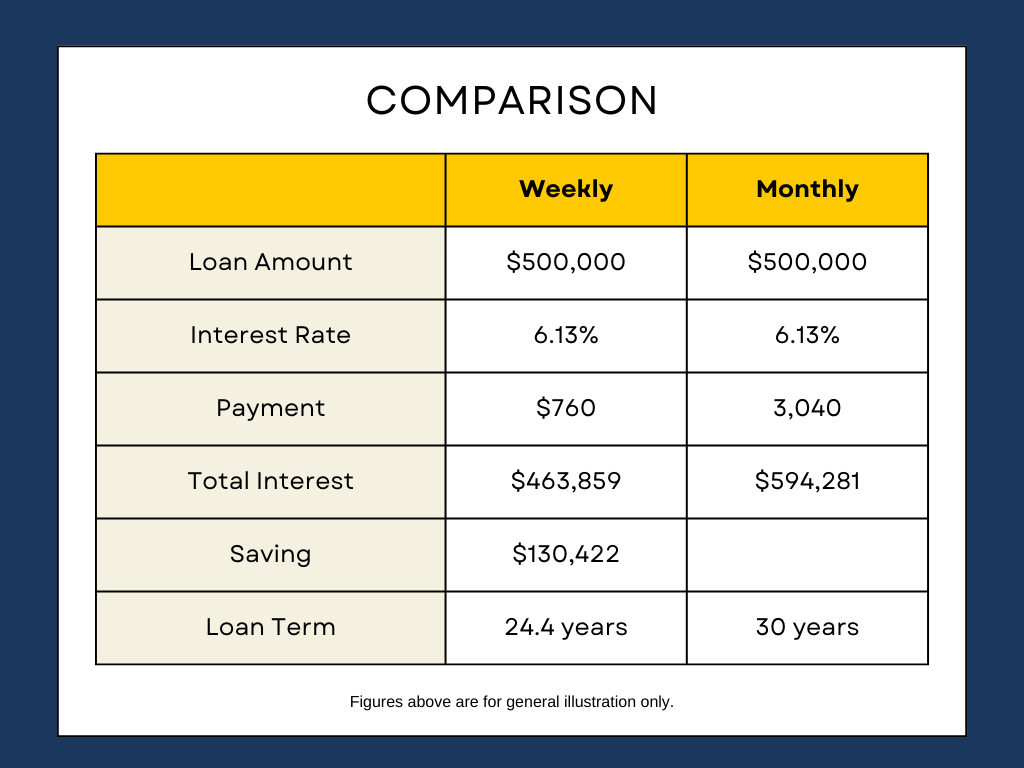

In the myth calculations there are 4 weeks in a month (the fact is there are 4.33 weeks per month), therefore if you divide $3,040 by 4, your weekly payment would be $760.

The reality of the calculation of four weeks in a month means that you are making additional repayments of $59 per week ($3,068 per annum)

The total interest saved in comparison to making the minimum repayment is more than $130K and reduces the loan term by over 5 years.

Hopefully, that’s cleared up that myth. If you are over-paying it’s not a bad thing, you will be able to create a good buffer and wipe out your loan earlier.

If you’d like to see how additional repayments can impact your loan check out our useful extra repayment calculator. If you need some assistance please get in touch.

Disclaimer: The figures shown above are for general illustration only.