Next financial year will see changes to both the First Home Guarantee Scheme and the Family Home Guarantee. The government is planning to expand the schemes allowing more than just Australian citizens to benefit from a low deposit to purchase an owner occupied property.

The government guarantee which has been in place since 2020 was only open to Australian citizens, the changes which will take effect from 1st July will see the scheme opened up to include permanent residents. The government has pledged 35,000 First Home Guarantee scheme places in the next financial year along with 10,000 Regional First Home Guarantee and 5,000 Family Home Guarantee places.

The scheme is administered by the National Housing Finance and Investment Corporation (NHFIC) and available through a limited number of lenders.

First Home Guarantee

From 1st July permanent residents will be able to purchase their first home with a 5% deposit plus costs (stamp duty and any other fees) without incurring lenders mortgage insurance. A further change is you will be able to apply to purchase a property with friends or family. The word “couple” will be changed from those who are married, or in de facto relationship, to “any two eligible individuals”.

To be eligible you must be a first home owner and not owned a property in Australia previously. There are some income and purchase price restrictions. Currently the income caps are $125,000 for a single applicant and $200,000 for a couple. The income is taken from the previous year’s ATO notice of assessment. It is anticipated that you will need to have completed your 2022/23 tax return to be eligible.

What does it actually mean in dollars?

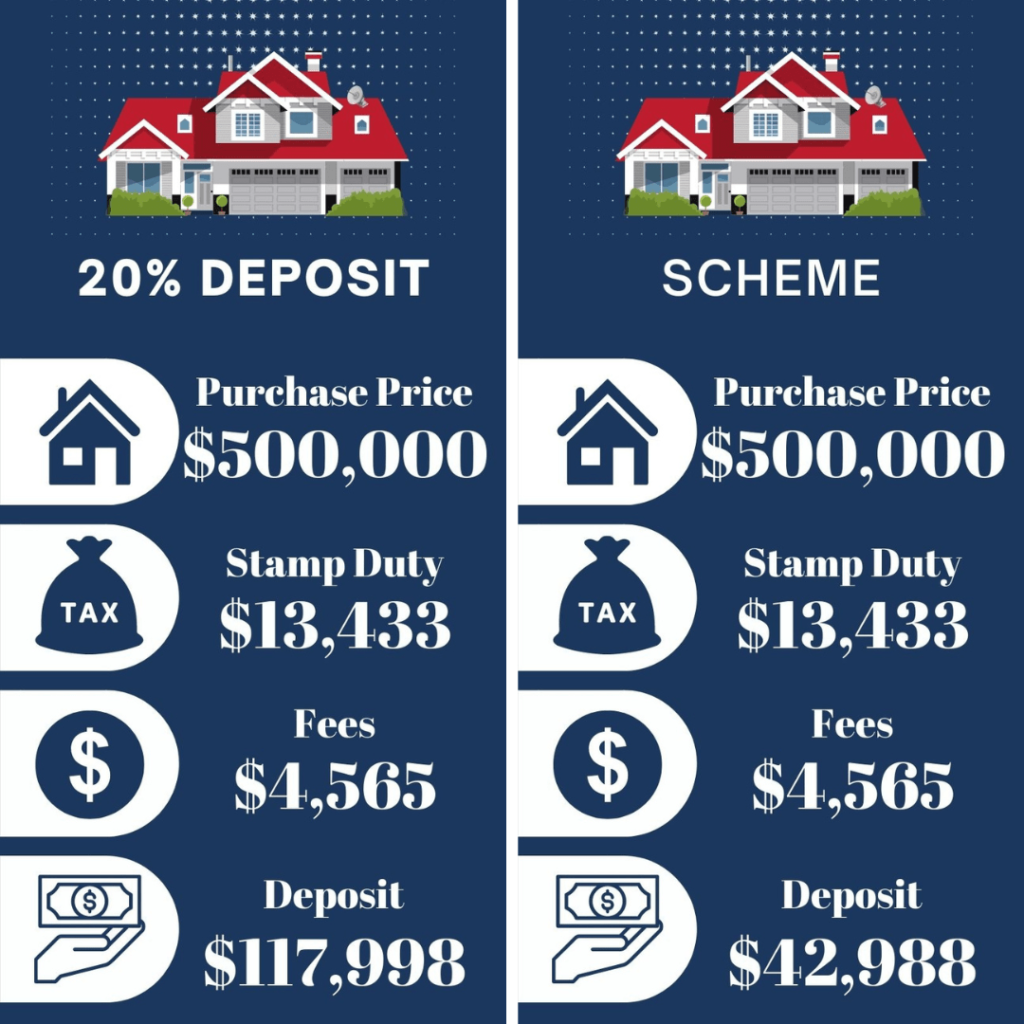

We have used the example below purchasing a first home in WA at $500,000. We have estimated costs and included WA stamp duty (with the first home buyer rebate loaded). Costs have been estimated to include transfer and registration fees along with $4,100 to cover settlement agent fees and council and water rates.

Many first home buyers do not have 20% deposit and would need to utilise lenders mortgage insurance (LMI). On the scenario above most lenders will allow a 95% loan including LMI, this would mean approximately a premium of $14,000* and still require a deposit of approximately $57,000. (*Estimated as each lender charges varying LMI premiums).

Family Home Guarantee

The Family Home Guarantee has the same income and price caps as the FHG, but is only available to single parents and have at least one dependent child. The scheme allows the purchase of a property with just a 2% deposit. Based on above scenario that would mean a deposit of $27,998 (for a first home buyer). The scheme is also available to those that have previously owned a property.

Changes to the criteria of this scheme too with meaning it will be available to eligible borrowers who are single legal guardians of children, such as aunts, uncles and grandparents. Scheme will also be available to permanent residents.

Need more information?

You can check your eligibility on the current scheme or you can contact us for more information.